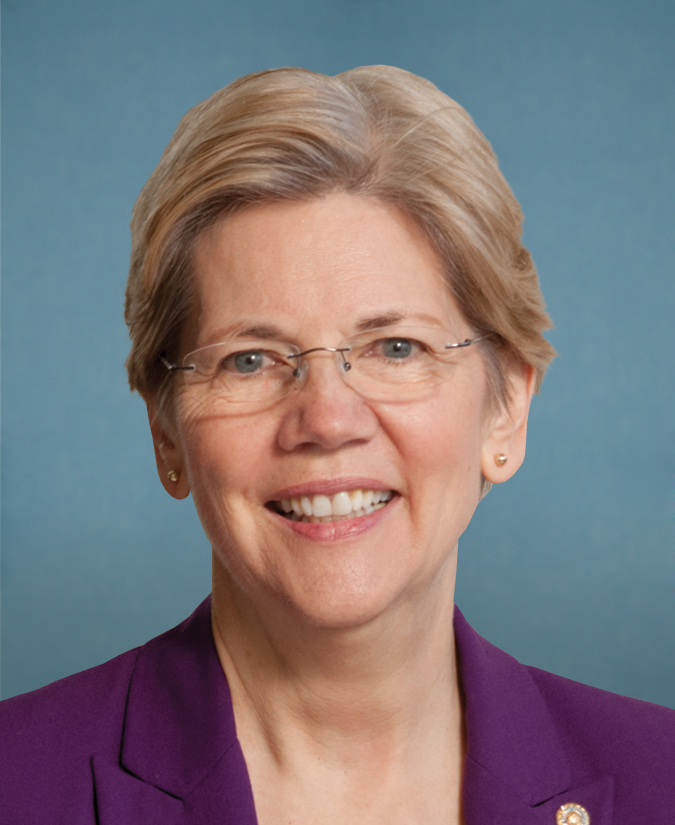

Sen. Elizabeth Warren

Stats

Sponsored Legislation

US Congress 115th Congress

Truth in Settlements Act of 2017 [S.1145]

[Law Enforcement ]

[Taxes ]

[Consumer Protection ]

[Finance ]

[Ethics ]

[Funding ]

Truth in Settlements Act of 2017 This bill sets forth new requirements for the public disclosure of any covered settlement agreement entered into by a federal executive agency. The bill defines "covered settlement agreement" as a settlement agreement (including a consent decree) that: (1) is entered into by an executive agency, (2) relates to an alleged violation of federal civil or criminal law, and (3) requires the payment of at least $1 million by one or more non-federal persons (entities not within the federal government). Each executive agency

(continued...)

US Congress 115th Congress

SAFE Banking Act Secure and Fair Enforcement Banking Act [S.1152]

[Cannabis ]

[Finance ]

[Small Business ]

[Insurance ]

[Real Estate ]

SAFE Banking Act Secure and Fair Enforcement Banking Act This bill prohibits a federal banking regulator from: (1) terminating or limiting the deposit insurance or share insurance of a depository institution solely because the institution provides financial services to a legitimate marijuana-related business; (2) prohibiting or otherwise discouraging a depository institution from offering financial services to such a business; (3) recommending, incentivizing, or encouraging a depository institution not to offer financial services to an account holder

(continued...)

US Congress 115th Congress

No Windfalls for Government Service Act [S.13]

[Taxes ]

[Ethics ]

No Windfalls for Government Service Act This bill amends the Internal Revenue Code to establish a $1 million lifetime limitation on the nonrecognition of a taxpayer's gains from the sale of property pursuant to a certificate of divesture to comply with conflict-of-interest requirements for certain federal government positions.

US Congress 115th Congress

A joint resolution approving the location of a memorial to commemorate and honor the members of the Armed Forces who served on active duty in support of Operation Desert Storm or Operation Desert Shield. [SJR-1]

[Defense ]

[Veterans ]

[Military ]

[National Security ]

[Public Lands and National Parks ]

A joint resolution approving the location of a memorial to commemorate and honor the members of the Armed Forces who served on active duty in support of Operation Desert Storm or Operation Desert Shield. This joint resolution approves the location within Washington, DC and the surrounding area of the National Desert Storm and Desert Shield Memorial authorized to be established under the Carl Levin and Howard P. 'Buck' McKeon National Defense Authorization Act for Fiscal Year 2015.

US Congress 115th Congress

Presidential Tax Transparency Act [S.26]

[Taxes ]

[Elections ]

[Ethics ]

[Finance ]

[Law Enforcement ]

[Crime ]

Presidential Tax Transparency Act This bill amends the Ethics in Government Act of 1978 to require the President and certain candidates for President to disclose federal income tax returns for the three most recent taxable years in reports filed with either the Office of Government Ethics (OGE) or the Federal Election Commission (FEC), in the case of a candidate. The OGE or the FEC must make the disclosed tax returns publicly available after making appropriate redactions. If the income tax returns are not disclosed as required by this bill, the

(continued...)

US Congress 115th Congress

A bill to establish an independent commission to examine and report on the facts regarding the extent of Russian official and unofficial cyber operations and other attempts to interfere in the 2016 United States national election, and for other purposes. [S.27]

[Cybersecurity ]

[Elections ]

[National Security ]

[Technology and Innovation ]

[Voting Rights ]

[Law Enforcement ]

[Data Privacy ]

[Public Safety ]

[Crime ]

A bill to establish an independent commission to examine and report on the facts regarding the extent of Russian official and unofficial cyber operations and other attempts to interfere in the 2016 United States national election, and for other purposes. This bill establishes the Commission to End Russian Interference in United States Elections as an independent commission to examine Russian cyber operations and attempts to interfere in the 2016 U.S. national election. The commission must examine attempts by the Russian government, governments or

(continued...)

US Congress 115th Congress

A concurrent resolution clarifying any potential misunderstanding as to whether actions taken by President-elect Donald Trump constitute a violation of the Emoluments Clause, and calling on President-elect Trump to divest his interest in, and sever his relationship to, the Trump Organization. [SCR-4]

[Ethics ]

[International ]

[Trade ]

[National Security ]

A concurrent resolution clarifying any potential misunderstanding as to whether actions taken by President-elect Donald Trump constitute a violation of the Emoluments Clause, and calling on President-elect Trump to divest his interest in, and sever his relationship to, the Trump Organization. Calls upon President-elect Donald J. Trump to: (1) follow the precedent established by prior Presidents and convert his assets to conflict-free holdings, adopt blind trusts, or take other equivalent measures to ensure compliance with the Emoluments Clause of

(continued...)

US Congress 115th Congress

Protect American Families Act Protect American Families from Unnecessary Registration and Deportation Act of 2017 [S.54]

[Immigration ]

[Race and Civil Rights ]

[National Security ]

[Human Rights ]

[Law Enforcement ]

Protect American Families Act Protect American Families from Unnecessary Registration and Deportation Act of 2017 This bill prohibits: (1) the Department of Homeland Security, the Department of Justice, or any other federal department from creating or implementing a law enforcement or national security program that requires or causes people to register or check in on the basis of religion, race, age, gender, ethnicity, national origin, nationality, or citizenship; and (2) federal funds from being used to create or implement an immigration registry

(continued...)

US Congress 115th Congress

Presidential Conflicts of Interest Act of 2017 [S.65]

[Ethics ]

[Finance ]

[Taxes ]

[Law Enforcement ]

[Crime ]

Presidential Conflicts of Interest Act of 2017 This bill requires the President and Vice President to submit to Congress and the Office of Government Ethics a disclosure of financial interests. Among the contents of such disclosure, the President and Vice President shall: (1) include a detailed description of each financial interest of the President and Vice President, the spouse of the President and Vice President, or a minor child of the President and Vice President; and (2) include the tax returns filed by or on behalf of the President and Vice

(continued...)

US Congress 115th Congress

Stop Subsidizing Multimillion Dollar Corporate Bonuses Act [S.82]

[Taxes ]

[Finance ]

[Labor, Jobs, Employment ]

Stop Subsidizing Multimillion Dollar Corporate Bonuses Act This bill amends the Internal Revenue Code, with respect to the $1 million limitation on the deductibility of employee compensation, to: (1) extend such limitation to any individual who is a current or former officer, director, or employee of a publicly-held corporation; (2) eliminate the exemption from such limitation for compensation payable on a commission basis or upon the attainment of a performance goal; and (3) make such limitation applicable to all publicly-held corporations that

(continued...)