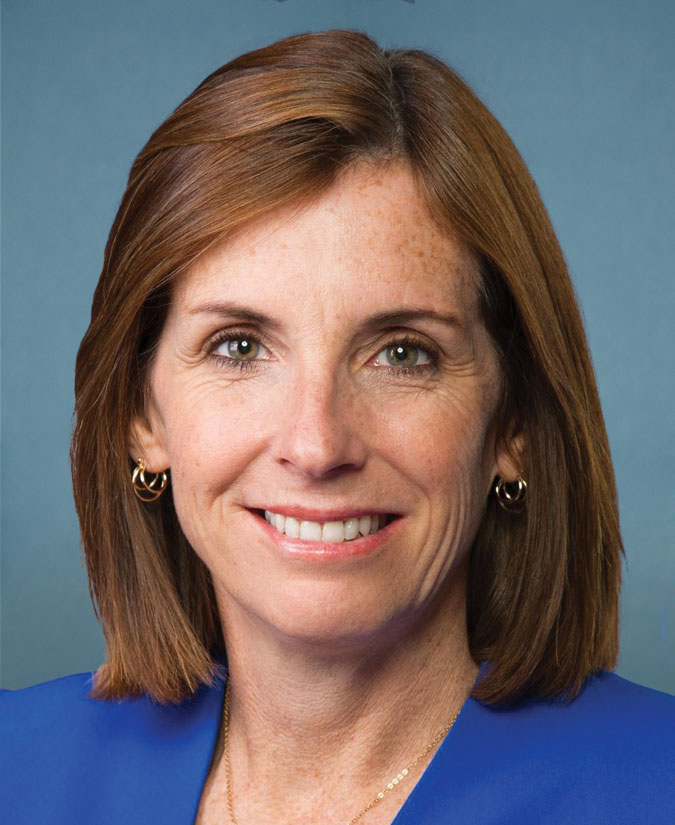

Sen. Martha McSally

Stats

District SD-AZ

Party Republican

Bills Introduced 106

Sponsored Legislation

US Congress 114th Congress

Condemning the Dog Meat Festival in Yulin, China, and urging China to end the dog meat trade. [HR-752]

[Animals ]

[Food ]

[International ]

[Public Health ]

[Trade ]

[Human Rights ]

Condemning the Dog Meat Festival in Yulin, China, and urging China to end the dog meat trade. Condemns the Dog Meat Festival in Yulin, China, because it: (1) is a spectacle of extreme animal cruelty, (2) is a commercial activity not grounded in Chinese history, (3) is opposed by a majority of the Chinese people, and (4) threatens global public health. Urges: the government of China and the Yulin authorities to ban the killing and eating of dogs as part of Yulin's festival and to enforce China's food safety laws regulating the processing and sale

(continued...)

Sponsored by: Rep. Sean Maloney

Referred To The Subcommittee On Asia And The Pacific. on 09/07/2016

US Congress 116th Congress

Circulating Collectible Coin Redesign Act of 2020 [S.4730]

[Arts and Culture ]

A bill to amend title 31, United States Code, to require the Secretary of the Treasury to mint and issue quarter dollars in commemoration of the Nineteenth Amendment, and for other purposes.

Sponsored by: Sen. Susan Collins

Read Twice And Referred To The Committee On Banking, Housing, And Urban Affairs. on 09/24/2020

US Congress 116th Congress

Paul Benne Specially Adaptive Housing Improvement Act of 2019 [S.2022]

[Housing ]

[Veterans ]

A bill to amend title 38, United States Code, to provide for improvements to the specially adapted housing program of the Department of Veterans Affairs, and for other purposes.

Sponsored by: Sen. Susan Collins

Read Twice And Referred To The Committee On Veterans' Affairs. on 06/27/2019

US Congress 116th Congress

A bill to amend the Internal Revenue Code of 1986 to make permanent the individual tax provisions of the tax reform law, and for other purposes. [S.1162]

[Taxes ]

[Budget and Spending ]

[Student Loans ]

[Medicare and Medicaid ]

[Healthcare ]

[Veterans ]

[Disabilities ]

[Military ]

Makes permanent several tax provisions that were enacted in 2017 and are scheduled to expire at the end of 2025. The bill makes permanent provisions that reduce individual tax rates, modify the taxation of the unearned income of children, allow a deduction for qualified business income of pass-through entities, increase the standard deduction, increase and modify the child tax credit, increase the limitation for certain charitable contributions, allow additional contributions to ABLE accounts (tax-favored accounts designed to enable individuals

(continued...)

Sponsored by: Sen. Martha McSally

Read Twice And Referred To The Committee On Finance. on 04/11/2019