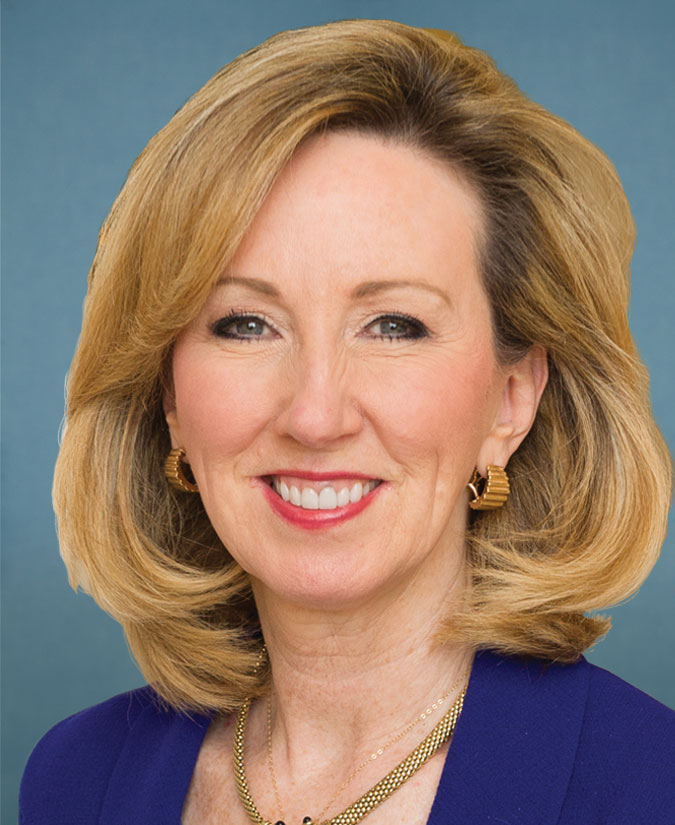

Rep. Barbara Comstock

Stats

Sponsored Legislation

US Congress 115th Congress

Veterans Transplant Coverage Act of 2017 [HB-1133]

[Healthcare ]

[Veterans ]

Veterans Transplant Coverage Act of 2017 (Sec. 2) This bill amends the Veterans Access, Choice, and Accountability Act of 2014 to authorize the Department of Veterans Affairs (VA) to: (1) provide for an operation on a live donor to carry out a transplant procedure for an eligible veteran, notwithstanding that the live donor may not be eligible for VA health care, and (2) provide for such an operation at a VA facility or a non-VA facility that has an agreement with the VA. (The live donor shall be deemed to be an individual eligible for hospital

(continued...)

US Congress 115th Congress

Granting the consent and approval of Congress for the Commonwealth of Virginia, the State of Maryland, and the District of Columbia to a enter into a compact relating to the establishment of the Washington Metrorail Safety Commission. [HJR-76]

[Transportation and Motor Vehicles ]

[Public Safety ]

Granting the consent and approval of Congress for the Commonwealth of Virginia, the State of Maryland, and the District of Columbia to a enter into a compact relating to the establishment of the Washington Metrorail Safety Commission. (Sec. 1) This joint resolution grants congressional consent and approval for the Commonwealth of Virginia, the state of Maryland, and the District of Columbia to enter into a Metrorail Safety Commission (MSC) Interstate Compact. The MSC Compact establishes a Washington Metrorail Safety Commission for the safety oversight

(continued...)

US Congress 115th Congress

No Hero Left Untreated Act [HB-1162]

[Veterans ]

[Healthcare ]

[Mental Health ]

[Overdose Prevention ]

[Public Health ]

No Hero Left Untreated Act This bill requires the Department of Veterans Affairs (VA) to carry out a one-year pilot program to provide access to magnetic EEG/EKG-guided resonance therapy to treat veterans suffering from post-traumatic stress disorder, traumatic brain injury, military sexual trauma, chronic pain, or opiate addiction. The VA shall: (1) carry out the program at up to two VA facilities, and (2) provide access to such therapy to more than 50 veterans.

US Congress 115th Congress

Health Savings Act of 2017 [HB-1175]

[Healthcare ]

[Medicare and Medicaid ]

[Taxes ]

[Insurance ]

[Public Health ]

[Social Security ]

[Funding ]

Health Savings Act of 2017 This bill amends the Internal Revenue Code, with respect to health savings accounts (HSAs), to: rename high deductible health plans as HSA-qualified health plans; allow spouses who have both attained age 55 to make catch-up contributions to the same HSA; make Medicare Part A (hospital insurance benefits) beneficiaries eligible to participate in an HSA; allow individuals eligible for hospital care or medical services under a program of the Indian Health Service or a tribal organization to participate in an HSA; allow members

(continued...)

US Congress 115th Congress

Working Families Flexibility Act of 2017 [HB-1180]

[Labor, Jobs, Employment ]

[Small Business ]

[Funding ]

Working Families Flexibility Act of 2017 (Sec. 2) This bill amends the Fair Labor Standards Act of 1938 to authorize employers to provide compensatory time off to private employees at a rate of not less than 1 1/2 hours for each hour of employment for which overtime compensation is required, but only if it is in accordance with an applicable collective bargaining agreement or, in the absence of such an agreement, an agreement between the employer and employee. The bill prohibits an employee from accruing more than 160 hours of compensatory time.

(continued...)

US Congress 115th Congress

Responsible Additions and Increases to Sustain Employee Health Benefits Act of 2017 [HB-1204]

[Healthcare ]

[Taxes ]

[Budget and Spending ]

[Insurance ]

[Labor, Jobs, Employment ]

Responsible Additions and Increases to Sustain Employee Health Benefits Act of 2017 This bill amends the Internal Revenue Code, with respect to the tax exclusion for distributions from health flexible spending arrangements provided under a cafeteria plan, to: (1) increase the annual limit on employee salary reduction contributions to $5,000, with an additional $500 for each additional employee dependent above two dependents that has not been taken into account by another person for the year; (2) revise the adjustment for inflation after 2017; and

(continued...)

US Congress 115th Congress

Collegiate Housing and Infrastructure Act of 2017 [HB-1200]

[Housing ]

[Taxes ]

[Education ]

[Construction ]

[Community Development ]

[Infrastructure ]

[Real Estate ]

Collegiate Housing and Infrastructure Act of 2017 This bill amends the Internal Revenue Code to allow tax-exempt charitable or educational organizations to make collegiate housing and infrastructure grants to certain tax-exempt social clubs (e.g., college fraternities and sororities) which apply such grants to their collegiate housing property. A "collegiate housing and infrastructure grant" is a grant to provide, improve, operate, or maintain collegiate housing property that may involve more than incidental social, recreational, or private purposes.

(continued...)

US Congress 115th Congress

Reducing Barriers for Veterans Education Act of 2017 [HB-1206]

[Veterans ]

[Education ]

[Funding ]

Reducing Barriers for Veterans Education Act of 2017 This bill makes an individual who is eligible for educational assistance under the Post-9/11 Educational Assistance program eligible for assistance with the fees for applying to institutions of higher education (IHEs). The amount of such assistance payable to an individual shall be the lesser of: (1) the total application fees charged to the individual by the IHEs, or (2) $750.

US Congress 115th Congress

Social Security Fairness Act of 2017 [HB-1205]

[Social Security ]

[Pensions ]

[Retirement ]

Social Security Fairness Act of 2017 This bill amends title II (Old Age, Survivors, and Disability Insurance) (OASDI) of the Social Security Act to repeal the "government pension offset" and the "windfall elimination provision." Under current law, those provisions reduce OASDI benefits for individuals who receive a pension based on earnings in government employment that was not covered under the Social Security program.

US Congress 115th Congress

To award a Congressional Gold Medal to Edwin Cole "Ed" Bearss, in recognition of his contributions to preservation of American Civil War history and continued efforts to bring our nation's history alive for new generations through his interpretive storytelling. [HB-1225]

[Arts and Culture ]

[Military ]

[Veterans ]

To award a Congressional Gold Medal to Edwin Cole "Ed" Bearss, in recognition of his contributions to preservation of American Civil War history and continued efforts to bring our nation's history alive for new generations through his interpretive storytelling. This bill directs the Speaker of the House of Representatives and the President pro tempore of the Senate to arrange for the presentation of a Congressional Gold Medal to Edwin Cole "Ed" Bearss in recognition of his contributions to the preservation of American Civil War history and his continued

(continued...)