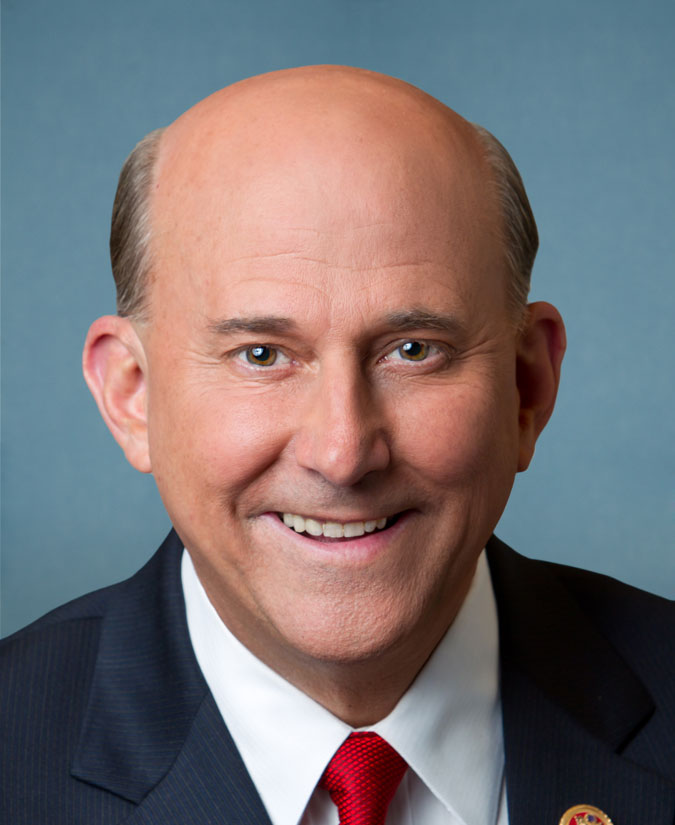

Rep. Louie Gohmert

Stats

Sponsored Legislation

US Congress 115th Congress

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the final rule of the Bureau of Land Management relating to "Onshore Oil and Gas Operations; Federal and Indian Oil and Gas Leases; Site Security". [HJR-56]

[Energy ]

[Public Lands and National Parks ]

[Environmental ]

[Mining ]

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the final rule of the Bureau of Land Management relating to "Onshore Oil and Gas Operations; Federal and Indian Oil and Gas Leases; Site Security". This joint resolution nullifies the rule submitted by the Bureau of Land Management titled "Onshore Oil and Gas Operations; Federal and Indian Oil and Gas Leases; Site Security." The rule published in the Federal Register on November 17, 2016, addresses site security for onshore oil and gas operations and production.

US Congress 115th Congress

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Environmental Protection Agency relating to "Accidental Release Prevention Requirements: Risk Management Programs under the Clean Air Act". [HJR-59]

[Environmental ]

[Air Quality ]

[Energy ]

[Public Safety ]

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Environmental Protection Agency relating to "Accidental Release Prevention Requirements: Risk Management Programs under the Clean Air Act". This joint resolution nullifies the Environmental Protection Agency's rule entitled, "Accidental Release Prevention Requirements: Risk Management Programs under the Clean Air Act." The rule addresses safety at facilities that use and distribute hazardous chemicals. It was published on January

(continued...)

US Congress 115th Congress

No Bonuses for Terrorists Act [HB-789]

[International ]

[National Security ]

[Defense ]

[Human Rights ]

[Funding ]

No Bonuses for Terrorists Act This bill amends the Foreign Assistance Act of 1961 to prohibit the provision of assistance to the Palestinian Authority (PA) and the Palestinian Liberation Organization (PLO) until the Department of State has certified that the PA and the PLO have ceased paying financial compensation or any other benefit not generally available to the Palestinian population at large to the families of Palestinians killed in connection with an act of terrorism. Recertification is required every six months. If the State Department is

(continued...)

US Congress 115th Congress

Free Speech Fairness Act [HB-781]

[Taxes ]

[Nonprofit ]

Free Speech Fairness Act This bill amends the Internal Revenue Code to permit a tax-exempt organization to make certain statements related to a political campaign without losing its tax-exempt status. An organization may not lose its tax-exempt status under section 501(c)(3) or be deemed to have participated in, or intervened in any political campaign on behalf of (or in opposition to) any candidate for public office, solely because of the content of any statement that: (1) is made in the ordinary course of the organization's regular and customary

(continued...)

US Congress 115th Congress

National Right-to-Work Act [HB-785]

[Labor, Jobs, Employment ]

National Right-to-Work Act This bill amends the National Labor Relations Act and the Railway Labor Act to repeal those provisions that permit employers or labor organizations, pursuant to a collective bargaining agreement that is a union security agreement, to require employees to join a union as a condition of employment (including provisions permitting railroad carriers to require, pursuant to such an agreement, payroll deduction of union dues or fees as a condition of employment).

US Congress 115th Congress

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the final rule of the United States Fish and Wildlife Service relating to the use of compensatory mitigation as recommended or required under the Endangered Species Act of 1973. [HJR-60]

[Environmental ]

[Public Lands and National Parks ]

[Animals ]

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the final rule of the United States Fish and Wildlife Service relating to the use of compensatory mitigation as recommended or required under the Endangered Species Act of 1973. This joint resolution nullifies the rule submitted by the U.S. Fish and Wildlife Service on December 27, 2016, about its compensatory mitigation policy under the Endangered Species Act for offsetting the impacts of development activities to endangered and threatened species and their

(continued...)

US Congress 115th Congress

No Transportation Funds for Sanctuary Cities Act [HB-824]

[Transportation and Motor Vehicles ]

[Immigration ]

[Infrastructure ]

[Budget and Spending ]

[Law Enforcement ]

[National Security ]

[Public Safety ]

No Transportation Funds for Sanctuary Cities Act This bill prohibits the obligation or expenditure of certain national infrastructure investment funds for discretionary grants (commonly known as Transportation Investment Generating Economic Recovery [TIGER] grants) for a surface transportation infrastructure investment project in a sanctuary jurisdiction. A "sanctuary jurisdiction" means a state or political subdivision that prohibits or restricts a government entity or official from: receiving, maintaining, or providing a federal, state, or local

(continued...)

US Congress 115th Congress

Tax Credit Accountability Act of 2017 [HB-819]

[Taxes ]

[Immigration ]

[Finance ]

Tax Credit Accountability Act of 2017 This bill amends the Internal Revenue Code to deny the earned income tax credit to any alien individual who is in an unlawful immigration status at any point during the taxable year.

US Congress 115th Congress

Military Surviving Spouses Equity Act [HB-846]

[Military ]

[Veterans ]

[Pensions ]

[Social Security ]

Military Surviving Spouses Equity Act This bill: (1) repeals certain provisions that require the offset of amounts paid in dependency and indemnity compensation from Survivor Benefit Plan (SBP) annuities for the surviving spouses of former military personnel who are entitled to military retired pay or who would be entitled to retired pay except for being under 60 years of age, (2) prohibits requiring repayment of certain amounts previously paid to SBP recipients in the form of a retired pay refund, and (3) requires (current law authorizes) the Secretary

(continued...)

US Congress 115th Congress

Agency Accountability Act of 2017 [HB-850]

[Budget and Spending ]

[Finance ]

[Taxes ]

[Law Enforcement ]

Agency Accountability Act of 2017 This bill requires any agency that receives a fee, fine, penalty, or proceeds from a settlement to deposit the amount in the general fund of the Treasury. The funds may not be used unless the funding is provided in advance in an appropriations bill. Any amounts deposited during the fiscal year in which this bill is enacted may not be obligated during the fiscal year and must be used for deficit reduction. The bill includes an exception for funds to be paid to an individual entitled to receive the funds as a whistle-blower,

(continued...)