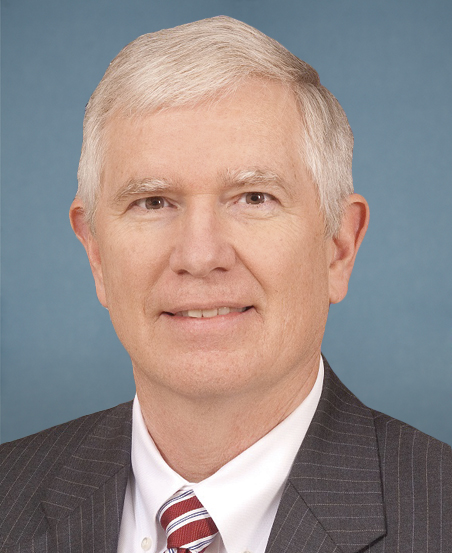

Rep. Mo Brooks

Stats

Sponsored Legislation

US Congress 115th Congress

Border Wall Funding Act of 2017 [HB-1813]

[Immigration ]

[Finance ]

[International ]

[Trade ]

[Budget and Spending ]

[Consumer Protection ]

[National Security ]

[Law Enforcement ]

[Funding ]

[Grants ]

[Human Rights ]

[Public Safety ]

Border Wall Funding Act of 2017 This bill amends the Electronic Fund Transfer Act to require a remittance transfer provider to collect from the sender a remittance fee of 2% of the U.S. dollar amount to be transferred to a recipient in Mexico, Guatemala, Belize, Cuba, the Cayman Islands, Haiti, the Dominican Republic, the Bahamas, Turks and Caicos, Jamaica, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Aruba, Curacao, the British Virgin Islands, Anguilla, Antigua and Barbuda, Saint Kitts and Nevis, Montserrat, Guadeloupe,

(continued...)

US Congress 115th Congress

EL CHAPO Act Ensuring Lawful Collection of Hidden Assets to Provide Order Act [HB-2186]

[Crime ]

[Criminal Justice ]

[Public Safety ]

EL CHAPO Act Ensuring Lawful Collection of Hidden Assets to Provide Order Act

US Congress 115th Congress

American Jobs First Act of 2017 [HB-2233]

[Immigration ]

[Labor, Jobs, Employment ]

[Trade ]

[Human Rights ]

[Economic Development ]

American Jobs First Act of 2017 This bill amends the the Immigration and Nationality Act to revise the H-1B nonimmigrant visa (specialty occupation) program, including by declaring that a petitioner employer: is offering an annual wage to the H-1B nonimmigrant that is the greater of the annual wage paid to the U.S. citizen or lawful permanent resident employee who did identical or similar work during the previous two years, or $110,000, if offered not later than one year after the date of enactment of this Act; will not require an H-1B nonimmigrant

(continued...)

US Congress 115th Congress

Volunteer Organization Protection Act of 2017 [HB-2432]

[Nonprofit ]

[Human Services ]

[Insurance ]

[Public Safety ]

[Community Development ]

[Law Enforcement ]

Volunteer Organization Protection Act of 2017 This bill amends the Volunteer Protection Act of 1997 to expand liability protections to volunteer nonprofit organizations for harm caused by an act or omission of a volunteer on behalf of the organization. The bill prohibits such liability protections from applying if the organization: (1) would be liable under laws governing the direct or vicarious liability of organizations, and (2) expressly authorized the specific conduct constituting the act or omission. The bill bars such an organization from

(continued...)

US Congress 115th Congress

Miners Protection Act of 2017 [HB-179]

[Energy ]

[Healthcare ]

[Labor, Jobs, Employment ]

[Pensions ]

[Mining ]

[Retirement ]

Miners Protection Act of 2017 This bill amends the Surface Mining Control and Reclamation Act of 1977 (SMCRA) to transfer certain funds to the Multiemployer Health Benefit Plan and the 1974 United Mine Workers of America (UMWA) Pension Plan to provide health and pension benefits to retired coal miners and their families. The bill expands the group whose retiree health benefits are taken into account in determining the amount that the Department of the Treasury must transfer from the Abandoned Mine Reclamation Fund and the General Fund of the Treasury

(continued...)

US Congress 115th Congress

New IDEA Act New Illegal Deduction Elimination Act [HB-176]

[Immigration ]

[Taxes ]

[Labor, Jobs, Employment ]

[Social Security ]

New IDEA Act New Illegal Deduction Elimination Act This bill amends the Internal Revenue Code to deny a tax deduction for wages and benefits paid to or on behalf of an unauthorized alien. The bill also extends to six years the period for assessing and collecting underpayments of tax due to deductions claimed for wages paid to unauthorized aliens. The Social Security Administration (SSA), the Department of Homeland Security (DHS), and the Department of the Treasury must jointly establish a program to share information that may lead to the identification

(continued...)

US Congress 115th Congress

Mobilizing Against Sanctuary Cities Act [HB-83]

[Immigration ]

[Crime ]

[Funding ]

[Law Enforcement ]

[National Security ]

[Public Safety ]

Mobilizing Against Sanctuary Cities Act This bill prohibits a state or local government from receiving federal financial assistance for a minimum of one year if it restricts or prohibits a government entity or official from: (1) sending to or receiving from the responsible federal immigration agency information regarding an individual's citizenship or immigration status, or (2) maintaining or exchanging information about an individual's status. The bill restores assistance eligibility upon a Department of Justice (DOJ) determination that the jurisdiction

(continued...)

US Congress 115th Congress

FairTax Act of 2017 [HB-25]

[Taxes ]

[Budget and Spending ]

[Medicare and Medicaid ]

[Social Security ]

[Healthcare ]

[Senior Citizens ]

[Poverty ]

FairTax Act of 2017 This bill is a tax reform proposal that imposes a national sales tax on the use or consumption in the United States of taxable property or services in lieu of the current income and corporate income tax, employment and self-employment taxes, and estate and gift taxes. The rate of the sales tax will be 23% in 2019, with adjustments to the rate in subsequent years. There are exemptions from the tax for used and intangible property, for property or services purchased for business, export, or investment purposes, and for state government

(continued...)

US Congress 115th Congress

Separation of Powers Restoration Act of 2017 [HB-76]

[Law Enforcement ]

Separation of Powers Restoration Act of 2017 This bill modifies the scope of judicial review of agency actions to authorize courts reviewing agency actions to decide de novo (without giving deference to the agency's interpretation) all relevant questions of law, including the interpretation of: (1) constitutional and statutory provisions, and (2) rules made by agencies. No law may exempt such a civil action from the application of the amendments made by this bill except by specific reference to these provisions.

US Congress 115th Congress

Federal Reserve Transparency Act of 2017 [HB-24]

[Finance ]

[Budget and Spending ]

[Taxes ]

Federal Reserve Transparency Act of 2017 (Sec. 2) This bill directs the Government Accountability Office (GAO) to complete, within 12 months, an audit of the Federal Reserve Board and Federal Reserve banks. In addition, the bill allows the GAO to audit the Federal Reserve Board and Federal Reserve banks with respect to: (1) international financial transactions; (2) deliberations, decisions, or actions on monetary policy matters; (3) transactions made under the direction of the Federal Open Market Committee; and (4) discussions or communications

(continued...)