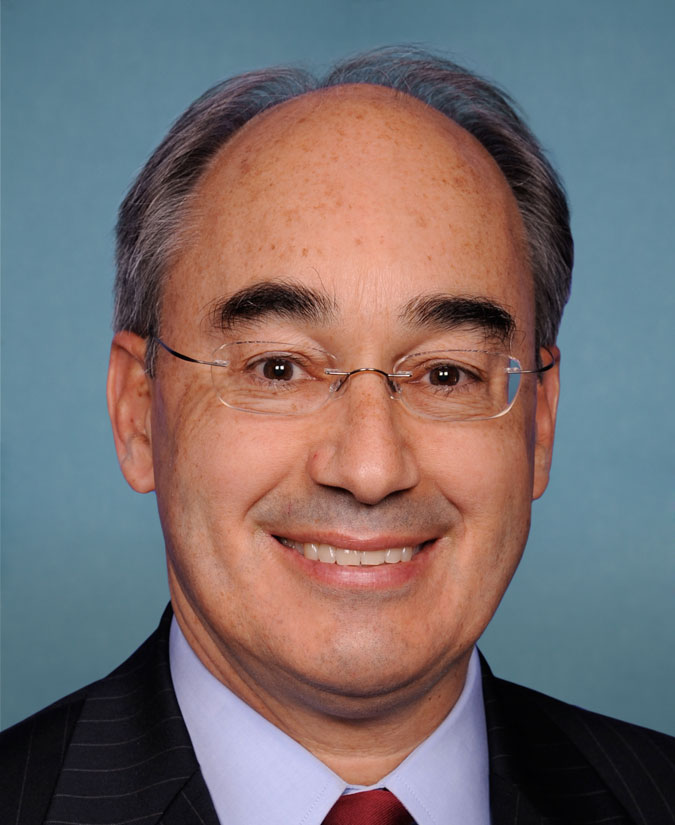

Rep. Bruce Poliquin

Stats

Sponsored Legislation

US Congress 115th Congress

Historic Tax Credit Improvement Act of 2017 [HB-1158]

[Taxes ]

[Real Estate ]

[Construction ]

[Small Business ]

Historic Tax Credit Improvement Act of 2017 This bill amends the Internal Revenue Code, with respect to the tax credit for the rehabilitation of buildings and historic structures, to: (1) allow an increased 30% credit, up to $750,000, for projects with rehabilitation expenditures not exceeding $3.75 million, for which no credit was allowed in either of the two prior taxable years (smaller projects); (2) allow the transfer of tax credit amounts for smaller projects; (3) treat a building as substantially rehabilitated if rehabilitation expenditures

(continued...)

US Congress 115th Congress

Shauna Hill Post 9/11 Education Benefits Transferability Act [HB-1112]

[Veterans ]

[Education ]

[Military ]

Shauna Hill Post 9/11 Education Benefits Transferability Act This bill authorizes the reassignment a veteran's or Armed Forces member's Post-9/11 education benefits to another eligible dependent in cases where the original designated beneficiary dies without having used all of such benefits. Such provision shall apply to deaths occurring on or after August 1, 2009.

US Congress 115th Congress

Removing Outdated Restrictions to Allow for Job Growth Act [HB-1177]

[Agriculture ]

[Economic Development ]

[Labor, Jobs, Employment ]

[Small Business ]

[Real Estate ]

Removing Outdated Restrictions to Allow for Job Growth Act (Sec. 2) This bill directs the Department of Agriculture, if requested in writing by the city of Old Town, Maine, to release, convey, and quitclaim to the city, without monetary consideration, all rights, title, and interest of the United States in and to lands that: (1) were conveyed by the federal government to the city under the Bankhead-Jones Farm Tenant Act by the deed dated June 5, 1941, and (2) are proposed for conveyance by the city for the purpose of economic development.

US Congress 115th Congress

Pre-existing Conditions Protection Act of 2017 [HB-1121]

[Healthcare ]

[Insurance ]

[Consumer Protection ]

[Public Health ]

Pre-existing Conditions Protection Act of 2017 This bill sets forth amendments that would take effect in the case of the repeal of the Patient Protection and Affordable Care Act (PPACA) and the health care provisions of the Health Care and Education Reconciliation Act of 2010 and the restoration of the provisions amended by those provisions. If the amendments take effect, the Public Health Service Act, the Employee Retirement Income Security Act of 1974 (ERISA), and Internal Revenue Code are revised to maintain PPACA consumer protections. Specifically,

(continued...)

US Congress 115th Congress

Expressing support for designation of April 11 as "National Pet Adoption Day" and the month of April as "National Pet Adoption Month" to highlight the important role pets play in the lives of United States citizens. [HR-133]

[Animals ]

Expressing support for designation of April 11 as "National Pet Adoption Day" and the month of April as "National Pet Adoption Month" to highlight the important role pets play in the lives of United States citizens. Supports the designation of April 11 as National Pet Adoption Day and the month of April as National Pet Adoption Month.

US Congress 115th Congress

TAILOR Act of 2017 Taking Account of Institutions with Low Operation Risk Act of 2017 [HB-1116]

[Finance ]

[Budget and Spending ]

[Small Business ]

[Investments ]

TAILOR Act of 2017 Taking Account of Institutions with Low Operation Risk Act of 2017 (Sec. 2) This bill requires federal financial regulatory agencies to: (1) tailor any regulatory actions so as to limit burdens on the institutions involved, with consideration of the risk profiles and business models of those institutions; and (2) report to Congress on specific actions taken to do so, as well as on other related issues. The bill's tailoring requirement applies not only to future regulatory actions but also to regulations adopted within the last

(continued...)

US Congress 115th Congress

Social Security Fairness Act of 2017 [HB-1205]

[Social Security ]

[Pensions ]

[Retirement ]

Social Security Fairness Act of 2017 This bill amends title II (Old Age, Survivors, and Disability Insurance) (OASDI) of the Social Security Act to repeal the "government pension offset" and the "windfall elimination provision." Under current law, those provisions reduce OASDI benefits for individuals who receive a pension based on earnings in government employment that was not covered under the Social Security program.

US Congress 115th Congress

VA Accountability First Act of 2017 [HB-1259]

[Veterans ]

[Labor, Jobs, Employment ]

[Pensions ]

[Law Enforcement ]

[Public Safety ]

[Military ]

[Crime ]

VA Accountability First Act of 2017 (Sec. 3) This bill revises the authority of the Department of Veterans Affairs (VA) to remove, demote by a reduction in grade and pay, or suspend a VA employee, including a member in a senior executive position, for reasons of performance or misconduct. A demoted individual shall not be placed on administrative leave during the appeals period and may receive pay only if he or she reports for duty or is approved to use certain accrued unused leave. An expedited appeals process is established for such VA decisions,

(continued...)

US Congress 115th Congress

Congratulating the New England Patriots on their victory in Super Bowl LI. [HR-169]

[Sports ]

Congratulating the New England Patriots on their victory in Super Bowl LI. Congratulates the New England Patriots on their victory in Super Bowl LI.

US Congress 115th Congress

Small Business Capital Formation Enhancement Act [HB-1312]

[Finance ]

[Small Business ]

[Economic Development ]

[Investments ]

Small Business Capital Formation Enhancement Act (Sec. 2) This bill amends the Small Business Investment Incentive Act of 1980 with respect to the annual government-business forum of the Securities and Exchange Commission (SEC) to review the current status of problems and programs relating to small business capital formation. The SEC shall review the forum's findings and recommendations and issue a public statement promptly assessing each submitted finding or recommendation and disclosing any action the SEC intends to take on it. Nothing in this

(continued...)