S 337 Bring Jobs Home Act

US Congress 113th Congress

Bring Jobs Home Act

S.337

About S.337

Bring Jobs Home Act - Amends the Internal Revenue Code to:

- (1) grant business taxpayers a tax credit for up to 20% of insourcing expenses incurred for eliminating a business located outside the United States and relocating it within the United States, and

- (2) deny a tax deduction for outsourcing expenses incurred in relocating a U.S. business outside the United States

Requires an increase in the taxpayer's employment of full-time employees in the United States in order to claim the tax credit for insourcing expenses.

Bill Texts

Introduced 02/27/2013

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

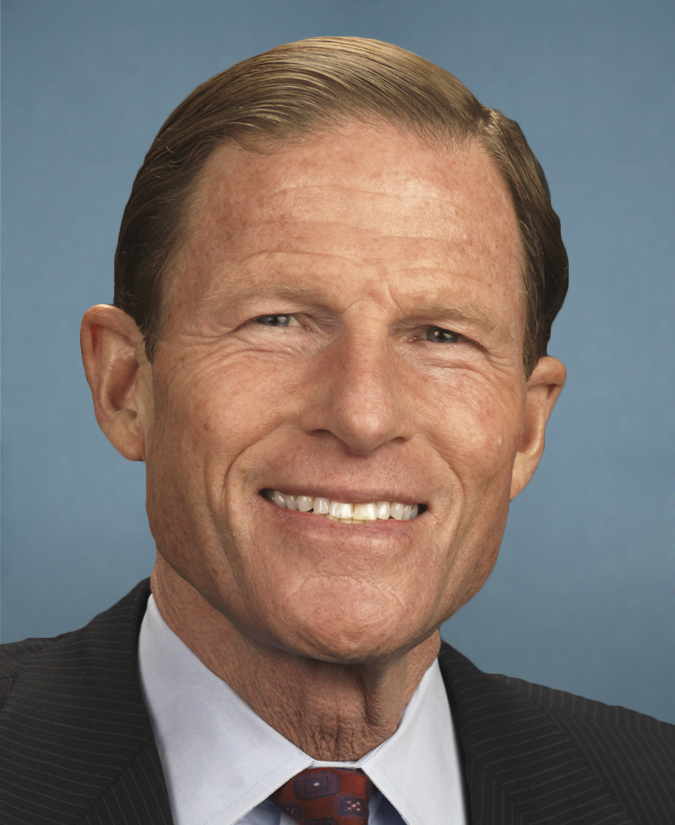

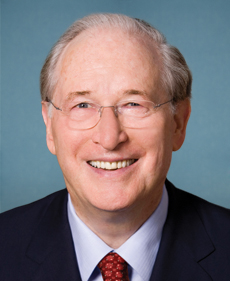

Sponsors (11)