HB 3468 Scale up Manufacturing Investment Company Act of 2015

US Congress 114th Congress

Scale-up Manufacturing Investment Company Act of 2015

HB-3468

About HB-3468

Scale-up Manufacturing Investment Company Act of 2015 This bill amends the Small Business Investment Act of 1958 to require the Small Business Administration (SBA) to establish a scale-up manufacturing investment company (SUMIC) program under which it shall provide leverage to participating investment funds (PIFs) to support debt and equity investments in qualifying manufacturing projects of specified small and emerging manufacturers. Within 60 days after SBA approves and issues a license to operate as a PIF under SUMIC, it may provide up to $1 of leverage for every $1 of private capital raised by the PIF. The maximum amount of outstanding leverage made available in any given fiscal year: to any PIF may not exceed $500 million, and to all PIFs in aggregate may not exceed $1 billion. The private capital of a PIF must be at least $250 million. Any national bank, or any member bank of the Federal Reserve System or nonmember insured bank, to the extent permitted under state law, may invest in any one or more PIFs, or in any entity established to invest solely in PIFs. In no event must the total amount of such investments exceed 5% of the bank's capital and surplus. The SBA must charge a leverage fee of between 3% and 5.5% of the face amount of the leverage issued. Each PIF shall have authority to borrow money and issue debentures and preferred securities, subject to SBA limitations and regulations. Of the SBA leverage provided to a PIF:

- (1) at least 70% must be issued as debentures, and

- (2) up to 30% may be issued as preferred securities

The Federal Financing Bank may acquire such a debenture. A PIF must use its SBA leverage to make debt and equity investments in small and emerging manufacturers to carry out qualifying manufacturing projects. The SBA shall issue policy directives to provide for enhanced outreach efforts to increase investments by PIFs in small businesses owned and controlled by socially and economically disadvantaged individuals and by women, veterans, and individuals with disabilities. The SBA may establish a SUMIC Credit Council.

Bill Texts

Introduced 09/14/2015

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

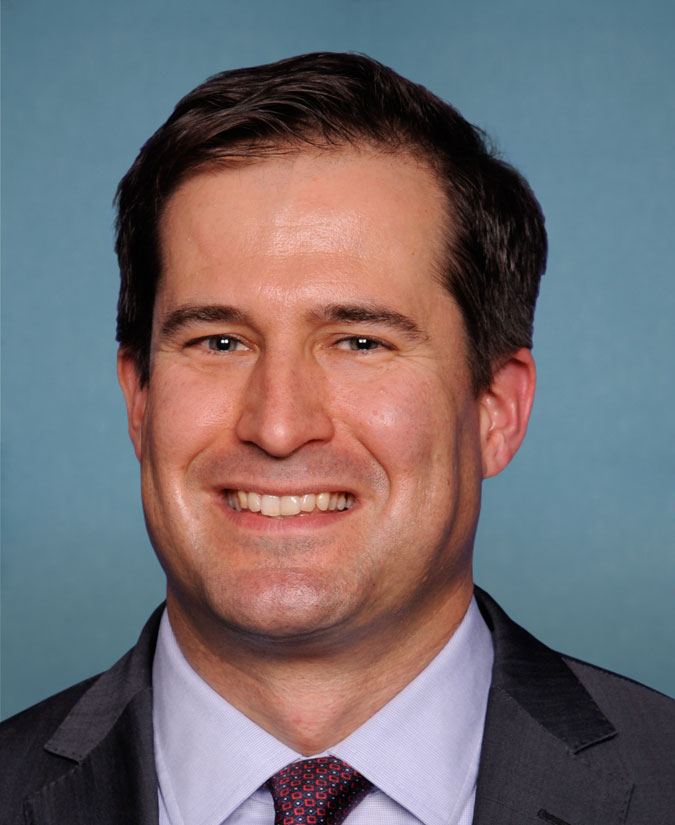

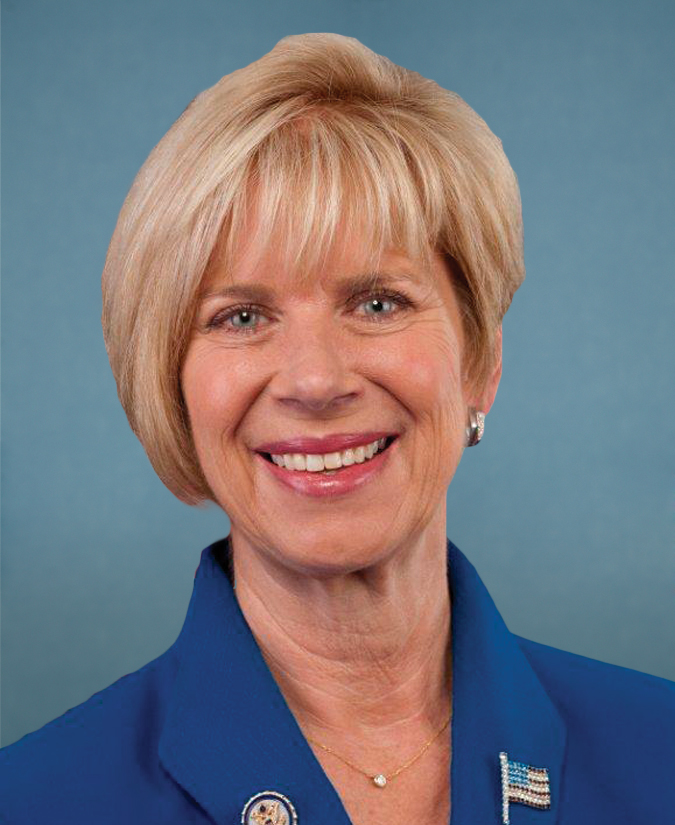

Sponsors (13)