HB 1545 To amend the Internal Revenue Code of 1986 to repeal the inclusion of certain fringe benefit expenses for which a deduction is disallowed in unrelated business taxable income

US Congress 116th Congress

To amend the Internal Revenue Code of 1986 to repeal the inclusion of certain fringe benefit expenses for which a deduction is disallowed in unrelated business taxable income.

HB-1545

About HB-1545

Modifies the requirements for determining the unrelated business taxable income of tax-exempt organizations. The bill repeals a provision that requires unrelated business taxable income to be increased by the amount of expenses paid or incurred by a tax-exempt organization for certain fringe benefits for which a tax deduction is not allowed, including benefits relating to transportation, parking, or an on-premises athletic facility.

Bill Texts

Introduced 03/22/2019

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

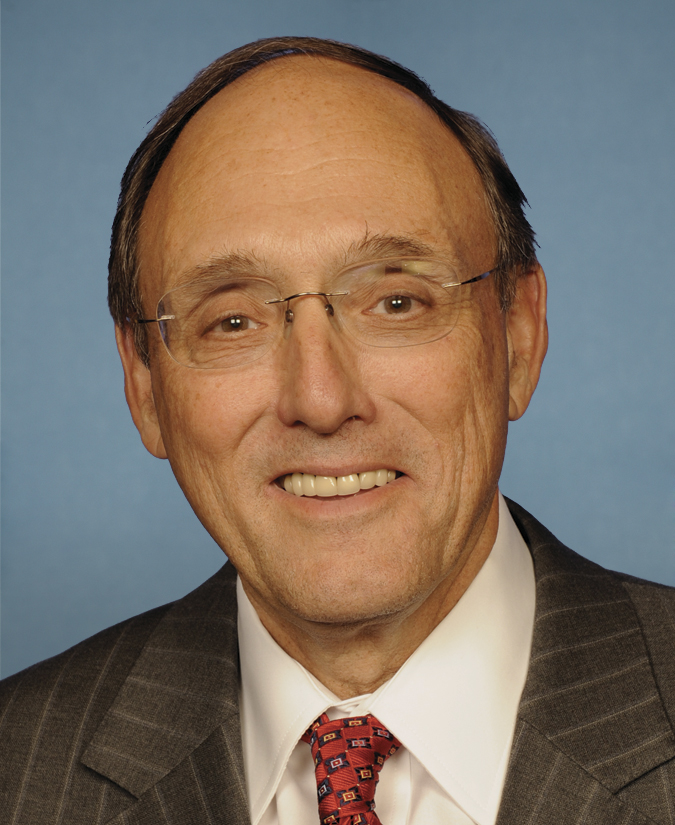

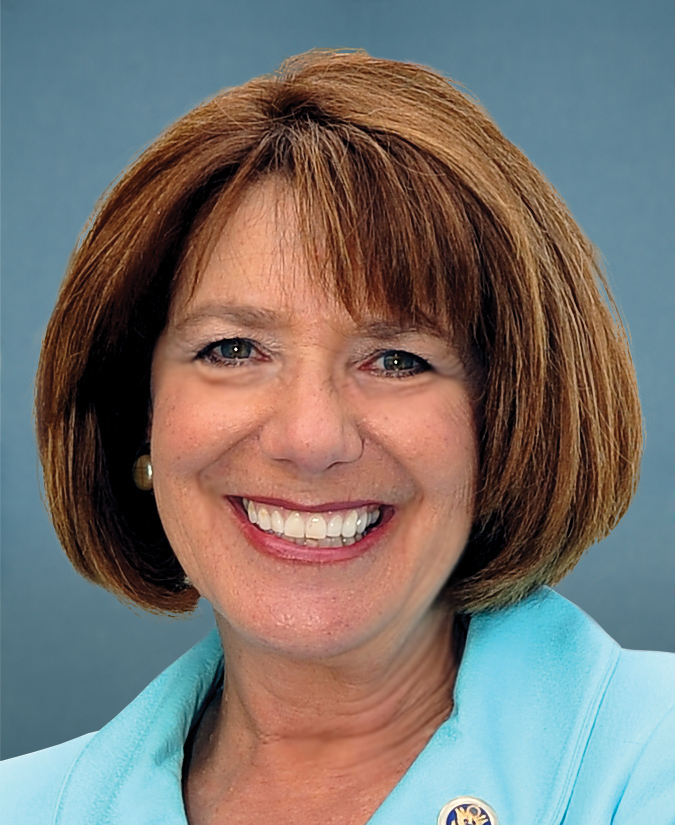

Sponsors (41)