S 1361 A bill to amend the Internal Revenue Code of 1986 to extend and improve the Indian coal production tax credit

US Congress 114th Congress

A bill to amend the Internal Revenue Code of 1986 to extend and improve the Indian coal production tax credit.

S.1361

About S.1361

A bill to amend the Internal Revenue Code of 1986 to extend and improve the Indian coal production tax credit. Amends the Internal Revenue Code, with respect to the tax credit for producing electricity from an Indian coal production facility, to eliminate:

- (1) the requirement that such a facility be placed in service before January 1, 2009, and

- (2) the limitation on the period during which such coal is required to be produced and sold.

Bill Texts

Introduced 05/26/2015

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

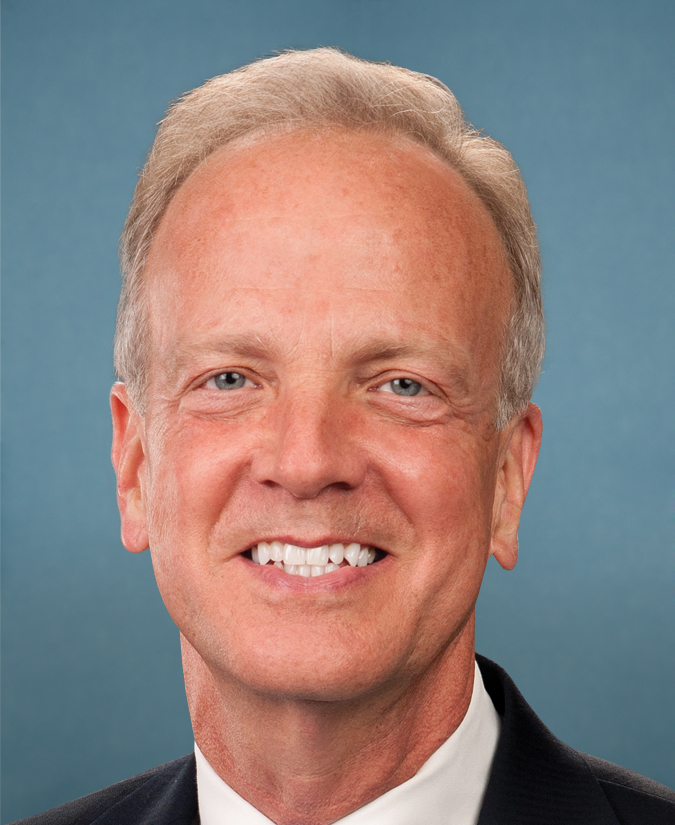

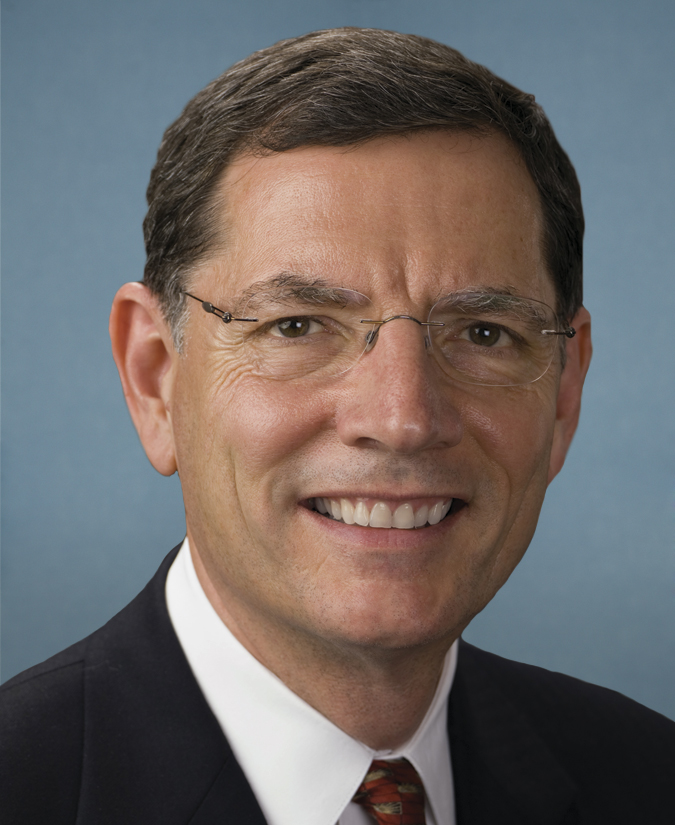

Sponsors (5)