HB 29 Tax Code Termination Act

US Congress 115th Congress

Tax Code Termination Act

HB-29

About HB-29

Tax Code Termination Act This bill terminates the Internal Revenue Code of 1986 after December 31, 2021, except for self-employment taxes, Federal Insurance Contributions Act (FICA) taxes, and railroad retirement taxes. A two-thirds majority vote in Congress is required to change such termination date. The bill declares that any new federal tax system should be a simple and fair system that:

- (1) applies a low rate to all Americans,

- (2) provides tax relief for working Americans,

- (3) protects the rights of taxpayers and reduces tax collection abuses,

- (4) eliminates the bias against savings and investment,

- (5) promotes economic growth and job creation, and

- (6) does not penalize marriage or families

The new federal tax system must be approved by Congress in its final form by July 4, 2021.

Bill Texts

Introduced 01/06/2017

Weigh In

Votes for: 2 Votes against: 0

Spread the Word!

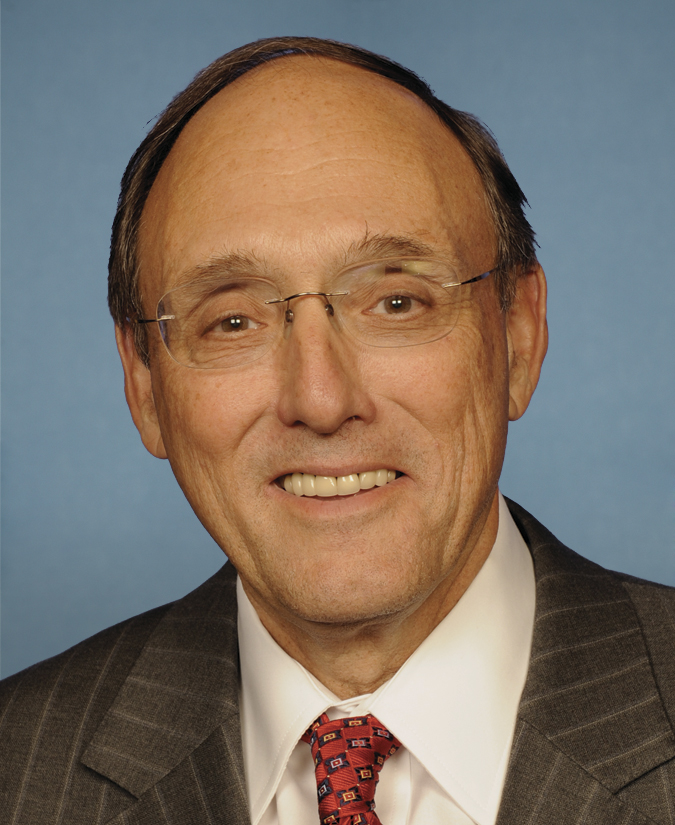

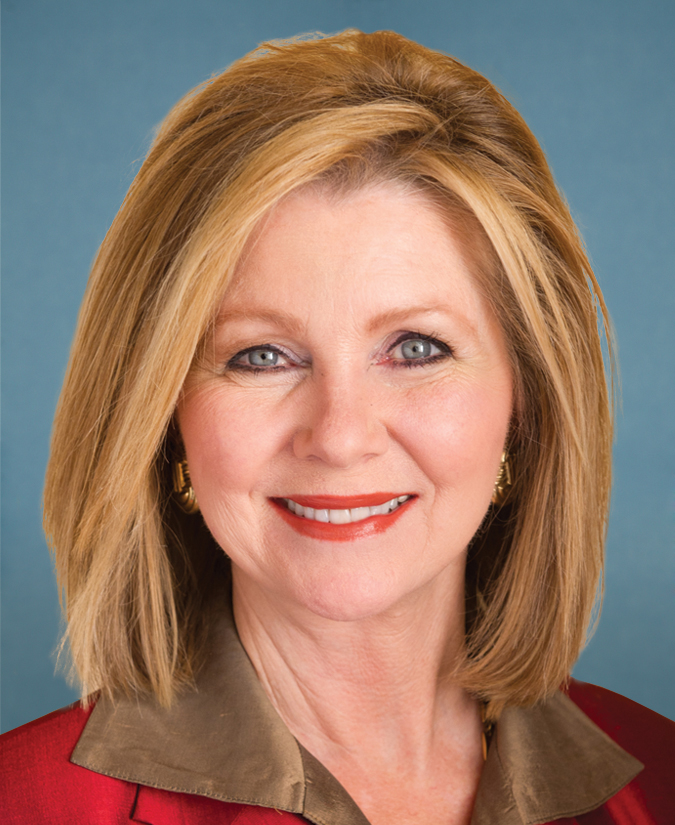

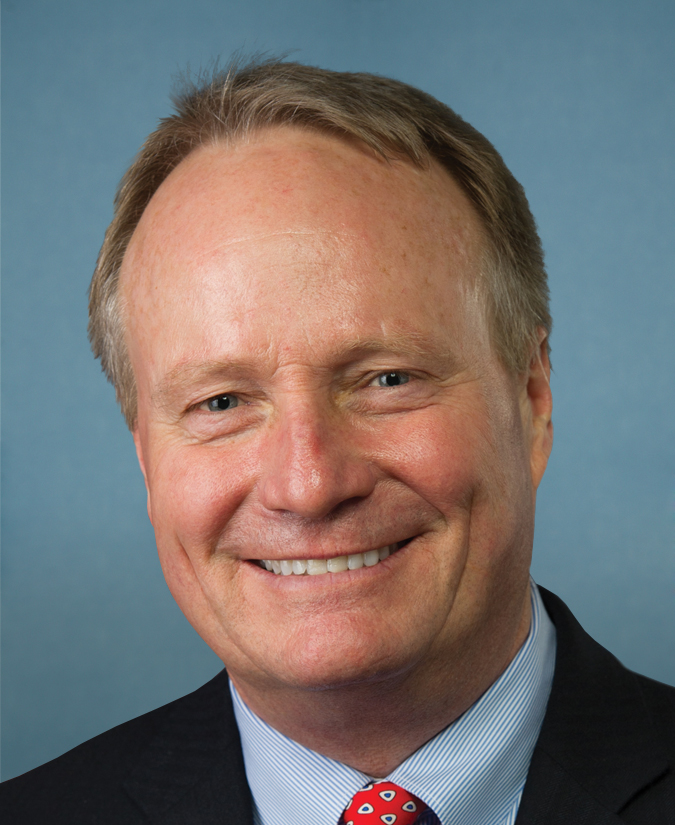

Sponsors (53)