S 2296 Workforce Health Improvement Program Act of 2015

US Congress 114th Congress

Workforce Health Improvement Program Act of 2015

S.2296

About S.2296

Workforce Health Improvement Program Act of 2015 This bill amends the Internal Revenue Code to modify the tax exclusion of the value of on-premises employer-provided athletic facilities. The bill provides for an exclusion from the gross income of an employee for:

- (1) the value of any on-premises employer-provided athletic facility; and

- (2) so much of the fess, dues, or other membership expenses paid by an employer on behalf of an employee, but not exceeding $900 per employee per year

The bill sets forth an expanded definition of "athletic or fitness facility," which specifies that the health or fitness component of such a facility cannot be incidental to its overall function and purpose. The bill also allows an employer to claim a tax deduction for the fees, dues, or membership expenses paid to an athletic or fitness facility on behalf of an employee.

Bill Texts

Introduced 11/25/2015

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

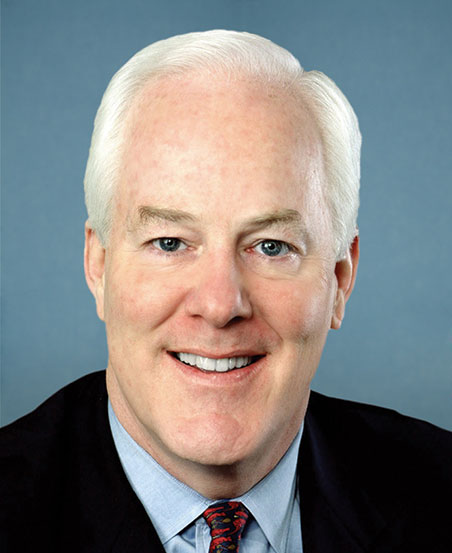

Sponsors (1)