HB 15 Middle Class Tax Cut Act

US Congress 112th Congress

Loading body...

Bill Texts

Introduced 08/02/2012

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

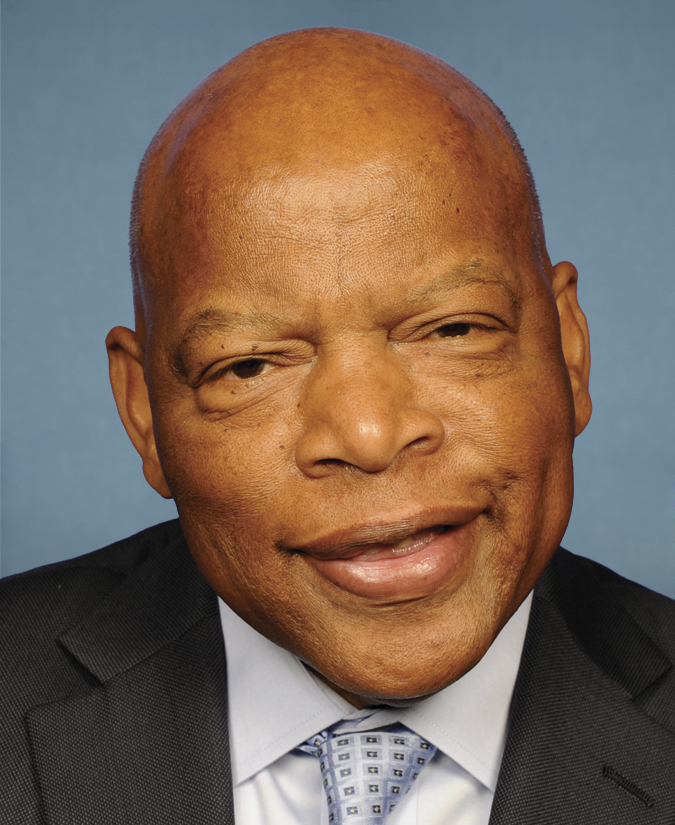

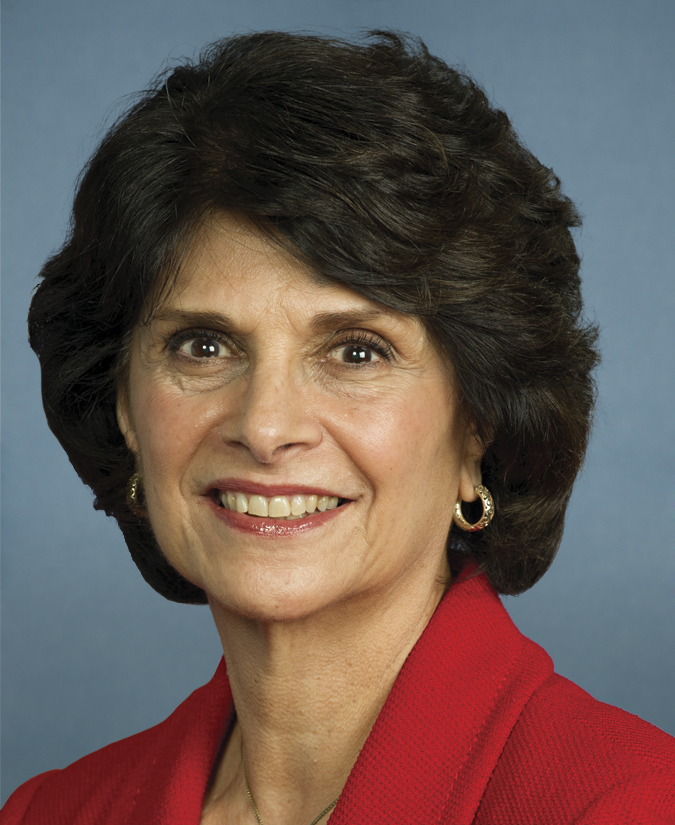

Sponsors (39)