HB 3397 Disaster Savings and Resilient Construction Act of 2015

US Congress 114th Congress

Loading body...

Bill Texts

Introduced 08/08/2015

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

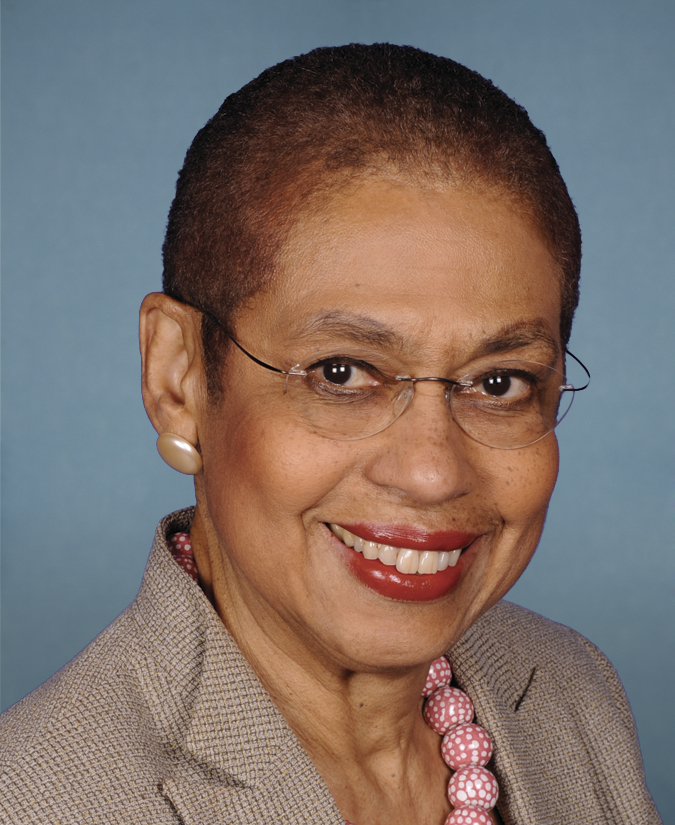

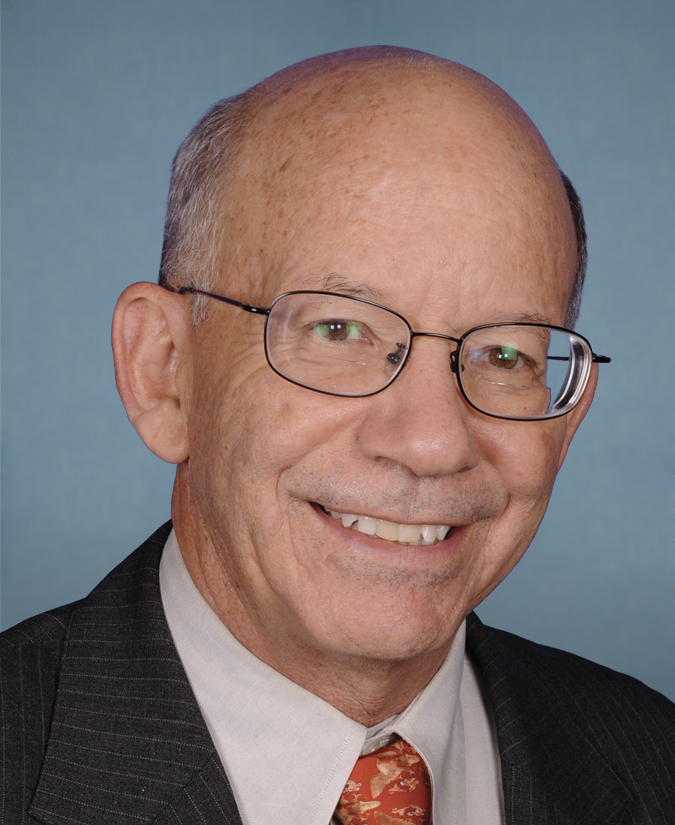

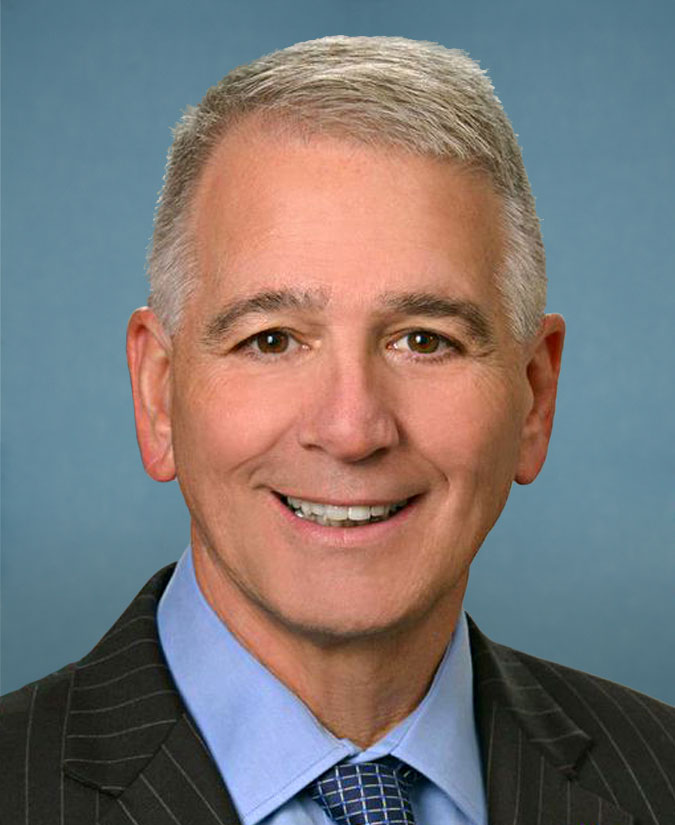

Sponsors (26)